Embarking on the journey to purchase a new construction home is filled with the excitement of envisioning life in a brand-new space tailored to your preferences. These homes, untouched and freshly built, offer a blank canvas for homeowners to inject their personal style and taste. Beyond the allure of customization and the latest home design, new construction homes promise the advantage of modern building standards and energy efficiencies. However, the glittering prospect of owning a brand new home also comes with its own set of considerations and due diligence.

Purchasing a home, particularly one that has yet to be lived in, is one of the most significant investments anyone can make. The process is fraught with decisions that can impact the joy and comfort your new home brings for years to come. It’s crucial to move beyond surface-level attractions and ensure your investment stands on solid ground—both literally and figuratively. This means arming yourself with knowledge and asking the right questions before signing the dotted line.

Your Guide

Buying a new construction home is a big investment, and asking the right questions is essential to ensure you’re making an informed decision. This comprehensive guide will explore 12 must-ask questions that cover warranties, construction quality, financial considerations, and more. With these insights, you’ll feel confident and prepared every step of the way.

To make it even easier, we’ve created a free, printable PDF checklist that you can download, print, and use when speaking with contractors. It’s a handy resource to help you keep track of the details and ensure nothing important gets overlooked.

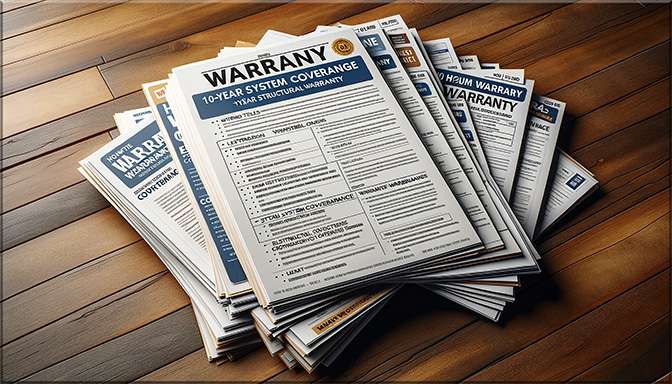

Question 1: What warranties do you offer?

1. Types Of Warranties:

New construction warranties typically encompass several key areas:

- Labor & Materials: This usually covers any defects in craftsmanship and the materials used in construction, such as roofing, windows, and finishes, often for up to one year.

- Systems: Coverage for the home’s mechanical systems—electrical, plumbing, heating, and air conditioning—extends beyond the basic warranty, usually up to two years.

- Structural Integrity: The most extended warranty, often up to ten years, covers significant structural defects that could compromise the home’s safety and livability.

2. Manufacturer Warranties:

In addition to the builder’s warranty, many components and appliances in your new home come with manufacturer warranties. These can include:

- Appliances: Kitchen appliances, water heaters, and HVAC units typically come with their own warranties, which can range from one to several years.

- Roofing Materials: Shingles and roofing materials may have separate warranties that protect against defects or failure.

- Windows & Doors: Manufacturer warranties on windows and doors can cover issues like seal failure or hardware defects.

3. Navigating Warranty Claims:

Understanding the process for filing a warranty claim is as important as knowing what the warranties cover.

- Documentation: Keep detailed records of all warranty documents and correspondence with the builder and manufacturers. This includes warranty certificates, purchase receipts, and maintenance records.

- Reporting Issues: Familiarize yourself with the procedure for reporting a warranty issue. Know whom to contact, the information needed to file a claim, and the expected timeline for resolution.

- Inspections: Some builders may require an inspection to verify warranty claims. Know how these inspections are scheduled and what to expect during the process.

4. Limitations & Exclusions:

Warranties come with specific limitations and exclusions. It’s vital to understand these to avoid surprises.

- Normal Wear & Tear: Warranties typically do not cover issues that arise from normal wear and tear or lack of maintenance.

- Natural Disasters: Damage from natural disasters, such as floods or earthquakes, is usually excluded from warranty coverage.

- Homeowner Modifications: Unauthorized modifications or repairs can void certain warranty protections.

5. Extended & Third-Party Warranties:

Some builders offer extended warranty options for additional coverage or peace of mind. Third-party warranty services can also provide supplemental coverage, especially for structural components.

- Cost & Coverage: Evaluate the cost of extended or third-party warranties against the additional coverage provided. Consider whether the extra expense is justified by your needs and the property’s characteristics.

The warranties on your new construction home are critical to your investment, offering protection and peace of mind. By thoroughly understanding the scope of coverage, the process for making claims, and the limitations of these warranties, you can confidently navigate homeownership. Armed with this knowledge, you’ll be better prepared to address any issues that arise, ensuring your home remains a source of comfort and security for years to come.

Question 2: Can you tell me about the construction quality & materials used?

1. Understanding Material Choices:

The materials chosen for your home affect its appearance, performance, and durability.

- Structural Materials: Inquire about the materials used for the foundation, framing, roofing, and insulation. High-quality materials in these areas are crucial for the home’s structural integrity and energy efficiency.

- Finishes: Ask about the types of materials used for interior and exterior finishes. Premium materials can enhance the home’s aesthetic appeal and longevity.

- Sustainability: Discuss the builder’s approach to using sustainable and eco-friendly materials. These choices can reduce your home’s environmental impact and potentially lower utility costs.

2. Assessing Construction Practices:

The methods and practices employed during construction play a significant role in the finished home’s quality.

- Building Standards: Learn about the building standards and codes the builder adheres to, going beyond the minimum requirements indicates a commitment to quality.

- Workmanship: Ask about the builder’s process for ensuring high-quality workmanship. This can include hiring experienced tradespeople and conducting thorough inspections throughout the construction process.

- Innovations: Inquire if the builder incorporates any innovative construction techniques or materials that enhance the home’s durability, efficiency, or comfort.

3. Certifications & Inspections:

Third-party certifications and inspections can offer an unbiased assessment of the home’s construction quality and environmental impact.

- Energy Efficiency Certifications: Certifications like ENERGY STAR or LEED for Homes indicate that the property meets stringent energy efficiency and sustainability standards.

- Quality Inspections: Ask if the home will undergo any third-party quality inspections beyond those required by local regulations. Independent inspections can provide peace of mind about the construction’s overall quality.

4. Previous Projects & References:

Seeing the builder’s previous work and hearing from past clients can provide insights into their quality standards and customer satisfaction.

- Touring Past Projects: If possible, visit homes previously constructed by the builder to assess their workmanship and how well the properties have aged.

- Speaking With Past Homeowners: Request references or contact details for past clients. Speaking with them can reveal the builder’s reliability, responsiveness to issues, and overall satisfaction with their homes.

5. Warranties & After-Sales Support

Understanding the warranties offered and the builder’s after-sales support process is essential for addressing any future concerns.

- Warranty Coverage: Clarify what warranties are provided for the structure, systems, and finishes. Comprehensive warranties can be a sign of the builder’s confidence in their work.

- Support Process: Inquire about the process for addressing any issues that arise after moving in. A responsive and supportive after-sales process is indicative of a builder committed to quality and customer satisfaction.

Thoroughly investigating the construction quality and materials used in your new home is vital for ensuring it meets your expectations for durability, efficiency, and sustainability. By asking detailed questions about material choices, construction practices, and certifications and inspecting previous projects, you can understand what to expect from your investment. This diligence helps secure a well-constructed and sustainable home and ensures it’s a place you’ll be proud to live in for years to come.

Question 3: What are the estimated property taxes & utility costs?

1. Property Taxes:

Property taxes are a major consideration for any homeowner, as they can vary significantly depending on the location and value of the property.

- Assessment of Property Value: Property taxes are typically based on the assessed value of the home and the land it sits on. Since new construction homes have yet to be assessed, the builder or local tax assessor’s office can offer estimates based on similar properties and planned amenities.

- Local Tax Rate: The property tax rate is determined by local government entities and can fluctuate. Contact the local tax assessor’s office or check their website for the current rates and any expected changes.

- Future Reassessments: Be aware that property values are periodically reassessed, which can lead to increases in property taxes. Ask about the frequency and history of reassessments in the area to gauge potential future tax liabilities.

2. Utility Costs:

Utility costs can also vary widely, depending on the size of the home, its energy efficiency, and local rates for services like water, electricity, gas, and waste disposal.

- Builder’s Estimates: Ask the builder for average utility costs in the development or for estimates based on the specific model of your home. Builders often have this information from similar completed homes.

- Energy Efficiency Ratings: Homes with higher energy efficiency ratings typically have lower utility costs. Inquire about the home’s energy features, such as insulation, windows, heating and cooling systems, and appliances, and how they impact utility costs.

- Personal Consumption Patterns: Consider how your lifestyle and usage patterns might differ from average estimates. For example, working from home, having a large family, or high electricity or water usage can affect your utility costs.

3. Additional Fees & Assessments:

In some areas, homeowners may be subject to additional fees or assessments for community amenities, infrastructure improvements, or special environmental protections.

- Community Fees: If your home is part of a community with shared amenities, there may be fees for the upkeep of these facilities that impact your budget.

- Special Assessments: Some local governments impose special assessments for improvements or services that benefit the community, such as street repairs or enhanced security. Ask the local authorities or your builder if any are planned or currently assessed.

4. Budgeting For The Long Term:

- Annual Increases: Utility rates and property taxes tend to increase over time. Factor in potential annual increases to your budgeting to avoid surprises.

- Energy-Saving Investments: Consider if investing in renewable energy sources like solar panels or energy-efficient appliances could reduce long-term utility costs despite the upfront expense.

Accurately estimating property taxes and utility costs is a critical step in assessing the total cost of ownership of a new construction home. You can create a more accurate budget by gathering detailed information from the builder and local authorities and assessing your usage patterns. This helps in understanding the immediate financial implications and planning for the long-term affordability of your home.

Question 4: Are there any homeowner association (HOA) fees, & what do they cover?

(if your buying a new construction located in an HOA

1. What HOA Fees Cover:

HOA fees are typically used to maintain common areas and provide services that benefit the community. This can include:

- Landscaping & Public Space Maintenance: Regular upkeep of green spaces, parks, community gardens, and walkways.

- Amenity Upkeep: Maintenance of communal facilities such as swimming pools, clubhouses, fitness centers, and playgrounds.

- Security: Some communities offer gated access or security personnel, contributing to a safer living environment.

- Utilities For Common Areas: Lighting for streets and public spaces, water for landscaping, and sometimes trash removal services.

- Insurance: Coverage for common areas and, in some cases, exterior structures of homes against certain damages or liabilities.

2. HOA Fee Variability:

Fees can range widely based on the community’s size, location, and the amenities offered. Luxury communities with extensive amenities will typically have higher HOA fees. It’s also important to note that fees can and often do increase over time to cover rising maintenance costs or unexpected expenses.

3. Special Assessments:

In addition to regular monthly or annual fees, HOAs can levy special assessments for significant repairs or upgrades that exceed the association’s reserve funds. Understanding the potential for such assessments and the process for their approval is important.

4. Reviewing HOA Documents:

Before purchasing, request and review the HOA’s governing documents, including the Declaration of Covenants, Conditions, and Restrictions (CC&Rs), bylaws, and budget. These documents provide critical information on:

- Rules & Restrictions: From paint colors and landscaping to parking and pet policies, these rules can affect your use of the property and personal freedoms.

- Financial Health: A well-funded reserve and prudent financial management are indicators of a healthy HOA, which can minimize the risk of unexpected assessments.

5. Impact On Lifestyle & Resale Value:

Living in an HOA-managed community can offer a convenient, well-maintained living environment, enhancing your quality of life and potentially your home’s resale value. However, the costs and regulations associated with HOAs can also be restrictive for some homeowners. Balancing these factors is key to making an informed decision that aligns with your lifestyle and financial goals.

While HOA fees can contribute significantly to the maintenance and security of a new construction community, they also represent an ongoing financial commitment and set of regulations to live by. Prospective buyers should thoroughly understand these aspects to make a decision that suits their needs and preferences. Asking detailed questions about HOA fees, their coverage, and the association’s financial health can provide valuable insights into what life in your potential new home could look like.

Question 5: Can I Customize floor plans or finishes? (relevant when using a non-custom blueprint)

1. Understanding Customization Levels:

Builders typically offer different levels of customization:

- Standard Options: These are pre-selected options included in the base price of the home, covering things like standard finishes and color schemes.

- Upgrade Options: Upgrades allow for more personalized choices beyond the standard options, often at an additional cost. This can include higher-quality materials, appliances, and more.

- Structural Customizations: Some builders allow changes to the floor plan itself, such as moving walls, adding rooms, or altering layouts. These changes can significantly impact the cost and timeline of the project.

2. Customization Process:

Familiarize yourself with the builder’s process for selecting customizations.

- Design Center: Many builders have a design center where buyers can view and select finishes, fixtures, and materials. Find out if appointments are needed and when selections must be finalized.

- Timeline for Decisions: There’s often a deadline for making customization choices, especially for structural changes, to avoid affecting the construction schedule.

3. Cost Implications:

Understanding how customizations impact the overall cost of your home is vital.

- Upgrade Costs: Ask for a price list of upgrade options to budget accordingly. It’s also helpful to know how these costs are financed – are they added to the overall mortgage, or are they required upfront?

- Structural Changes: Significant modifications to the floor plan can be costly. Request detailed quotes for any structural changes to understand the financial impact.

4. Impact On Construction Timeline:

Customizations, especially structural ones, can extend the construction timeline.

- Construction Delays: Ask the builder for realistic estimates on how customizations might delay the project. Understanding these potential delays can help you plan your move more effectively.

- Deadlines for Changes: There are usually cut-off points beyond which no more changes can be made without incurring significant delays and costs. Make sure you’re aware of these deadlines.

5. Warranty & Service:

Inquire how customizations affect the builder’s warranty.

- Warranty Coverage: Some builders may offer limited warranties on certain upgrades or modifications. Clarify what is covered and for how long.

- Post-Move-In Support: Ask if there is any additional support or service for customized features after you move in, especially for high-tech or unique installations.

While customization is a thrilling aspect of purchasing a new construction home, it requires careful consideration of available options, cost implications, and potential impacts on the construction timeline. By asking detailed questions about the customization process and the costs involved. How changes might affect your move-in date: you can make informed decisions that align with your budget, timeline, and vision for your new home. This ensures that your new construction home meets your aesthetic preferences and fits your lifestyle and financial plans.

Question 6: What is the neighborhood like, and what amenities are included?

(Relevant when purchasing a lot)

1. Assessing Community Amenities:

Amenities within a community significantly contribute to your daily enjoyment and convenience. Here’s what to look for:

- Recreational Facilities: Availability of swimming pools, tennis courts, gyms, and other recreational facilities can offer valuable leisure and fitness opportunities.

- Parks & Green Spaces: Green spaces not only enhance the beauty of a neighborhood but also provide areas for relaxation and play. They are especially important for families with children and pets.

- Walking & Biking Trails: Trails for walking, biking, or jogging add to the livability of a community, promoting a healthy lifestyle.

- Community Centers: These can serve as hubs for neighborhood activities, classes, and social gatherings, fostering a sense of community.

2. Proximity To Essential Services:

The convenience of having essential services nearby cannot be overstated. Consider the proximity to:

- Schools: Quality of education is paramount for families with children. Research local schools, their ratings, and if the community is within the desired school district.

- Shopping Centers: Easy access to shopping can make day-to-day life more convenient. Look for grocery stores, pharmacies, and retail shopping within a short drive.

- Healthcare Facilities: Proximity to hospitals, clinics, and emergency services is crucial, especially for families with young children or elderly members.

- Public Transportation: Access to public transportation options is a significant factor for those who commute or prefer not to drive.

3. Understanding Future Developments:

The current state of the neighborhood is just one part of the equation. Future development plans can impact your investment and quality of life:

- Planned Amenities: Ask about any additional amenities the builder or community plans to add in the future. This could include new parks, expansion of facilities, or additional shopping centers.

- Residential Development: Find out if there are plans for more homes or different types of housing to be built in the area. This can affect the community’s density, traffic, and overall feel.

- Commercial Development: Upcoming commercial projects can enhance the area’s appeal but may also bring increased traffic. Understanding these plans can help you gauge the future landscape of the neighborhood.

- Infrastructure Improvements: Inquire about any planned improvements to roads, utilities, and public services, as these can significantly impact the community’s accessibility and attractiveness.

4. Evaluating The Community's Vision & Values:

- Community Vision: Many communities have a vision or mission statement that outlines the lifestyle and values they promote. This can give you insight into whether the community is a good fit for your values and lifestyle.

- Resident Involvement: Look into how involved residents can be in community decisions. Active community associations or boards can indicate a well-managed and engaged community.

Question 7: How is the land around the property managed?

1. Landscaping & Green Space Maintenance:

The appearance and upkeep of common areas, parks, and green spaces can significantly impact the community’s aesthetic and your quality of life.

- Community Landscaping Plans: Ask about the landscaping plans for communal areas. Are there plans for native plant gardens, trees, and recreational green spaces?

- Homeowner Responsibilities: Clarify what landscaping obligations fall to homeowners. Are there guidelines or restrictions on the types of plants, trees, or lawn care products you can use?

2. Environmental Conservation Efforts:

Sustainable communities often incorporate environmental conservation into their land management practices.

- Protected Natural Features: Inquire if the development includes protected natural features, such as wetlands, woodlands, or wildlife habitats, and how these areas are preserved.

- Eco-friendly Practices: Ask about the use of eco-friendly landscaping practices, such as rain gardens, permeable paving, and water-efficient irrigation systems.

3. Stormwater Management:

Proper stormwater management is critical to prevent flooding, protect water quality, and ensure the resilience of the community.

- Stormwater Infrastructure: Understand how stormwater is managed. Are there detention ponds, rain gardens, or other infrastructure to manage runoff?

- Impact On Property: Consider how stormwater management (or lack thereof) might impact your property, especially if your home is in a lower elevation area of the community.

4. Shared Green Spaces & Amenities:

Shared amenities can enhance your living experience but come with maintenance considerations.

- Maintenance Of Shared Spaces: Who is responsible for the upkeep of shared amenities like parks, trails, and community gardens?

- Community Involvement: Is there a community association or group overseeing the management and use of these spaces? Can homeowners get involved?

5. Sustainability Initiatives:

Communities that prioritize sustainability may have specific initiatives in place.

- Sustainable Features: Are there community-wide sustainability features, such as solar panels, community composting, or energy-efficient lighting in common areas?

- Future Sustainability Plans: Does the builder have plans for future green initiatives within the community?

6. Legal & Regulatory Compliance:

Understanding the legal and regulatory context is also important.

- Compliance With Environmental Regulations: Ensure the development complies with local, state, and federal environmental regulations, especially if the community is near sensitive ecosystems.

- Homeowner Restrictions: Be aware of any legal restrictions or covenants that might limit your use of the property, especially concerning landscaping and outdoor modifications.

How land is managed around your new construction home can profoundly impact your lifestyle, your responsibilities as a homeowner, and the environment. You can gauge the community’s long-term viability and alignment with your values by asking detailed questions about landscaping, environmental conservation efforts, stormwater management, shared green spaces, and sustainability initiatives. This comprehensive understanding will help you make an informed decision about your potential new home, ensuring it meets your sustainability, beauty, and community living expectations.

Question 8: What is the timeline for construction & move-in?

1. Setting Realistic Expectations:

- Average Timelines: While timelines can vary greatly, understanding the average duration for new constructions in your area can provide a baseline. Typically, construction might take anywhere from 6 to 18 months, depending on the project’s scale, complexity, and local factors.

- Factors Influencing Timelines: Acknowledge that weather conditions, labor availability, material supply chain issues, and permitting processes can all influence the timeline. Ask the builder for their historical accuracy in meeting projected timelines and how they mitigate common delays.

2. Contingency Plans For Delays:

- Delay Mitigation: Inquire about the builder’s strategies for mitigating delays, including their relationships with suppliers and subcontractors and how they prioritize projects.

- Communication of Delays: Understand how the builder communicates delays to buyers. Regular updates, whether through email, a dedicated portal, or direct calls, can help manage expectations and allow for better personal planning.

3. Construction Phases & Milestones:

- Key Milestones: Ask the builder to outline the major construction phases (e.g., foundation laying, framing, interior finishes) and the estimated completion time for each phase. Knowing these milestones can help you track progress against the overall timeline.

- Inspection & Approval Points: Recognize that certain construction stages require municipal inspections and approvals before proceeding, which can influence the timeline. Clarify how these are scheduled and managed.

4. Finalizing For Move-In:

- Completion Certificates: Before move-in, a final inspection typically needs to be passed, and a certificate of occupancy issued by local authorities. Understanding this process can help you gauge the move-in timeline more accurately.

- Walkthrough & Punch List: Learn about the process for the final walkthrough, where you’ll identify any remaining issues or defects, and how these are addressed prior to move-in.

5. Planning Your Move:

- Flexible Planning: Given potential delays, plan your move with flexibility in mind. Consider temporary housing options if your move-out and move-in dates don’t align perfectly.

- Financial Cushion: Maintain a financial cushion to cover unexpected costs associated with delays, such as extended rental periods or storage fees.

While excitement about moving into a new construction home is understandable, it’s important to approach the construction and move-in timeline with a realistic perspective. You can plan more effectively by inquiring about average timelines, understanding the factors that can cause delays, and learning how the builder communicates and handles these delays. This preparation ensures that, despite the inherent uncertainties in any construction project, you remain informed and ready to adapt as needed.

Question 9: Are there any future development plans for the area?

1. Impact On Property Values:

Future developments can either positively or negatively impact property values in the area. For instance:

- Residential Expansions: Additional phases in residential development can increase supply, potentially affecting future property values.

- Commercial Developments: The introduction of shopping centers, restaurants, and offices can enhance the appeal of the area, potentially boosting property values due to increased amenities and convenience.

2. Quality Of Life Considerations:

The type of developments planned for the area can significantly impact your lifestyle and satisfaction with the location:

- Infrastructure Projects: Upgrades to roads, public transportation, and utilities can improve living conditions but might come with short-term disruptions during construction.

- Environmental & Recreational Spaces: The addition of parks, trails, and green spaces can enhance the community’s appeal and residents’ quality of life.

3. Gathering Information On Future Developments:

To make an informed decision, you need to gather detailed information about any planned developments:

- Municipal Planning Departments: These local government offices are a primary source of information on future developments, zoning changes, and long-term urban planning initiatives. They can provide insights into approved projects and those in the proposal stage.

- Public Meetings & Records: Attend town hall meetings, planning commission sessions, and review public records to learn about upcoming projects and community reactions to them.

- Builder and Developer Insights: Ask the builder or developer of your new home about their future plans for the surrounding area. They may have plans for additional phases or amenities that could influence your decision.

4. Evaluating The Timing & Phases Of Development

5. Considering Community Input & Opposition:

6. Legal & Environmental Assessments:

Question 10: What financing options are available?

Financing options for a new construction home is an essential step in the home buying process. Given that financing a new build can come with different considerations compared to purchasing an existing home, it’s crucial to be well-informed about your options, potential incentives, and the overall financial implications.

Financing a new construction home involves understanding the unique products, terms, and conditions that apply to these types of properties. Here’s a comprehensive look at how to approach financing:

1. Builder's Preferred Lenders:

Many builders establish relationships with specific lenders, offering potential benefits to buyers who choose to finance their purchase through these preferred lenders. Consider the following:

- Incentives: Builders may offer compelling incentives to use their preferred lenders, such as covering closing costs, providing upgrades, or offering discounts. These incentives can significantly reduce your out-of-pocket expenses.

- Lender Reputation: Research the preferred lender’s reputation, customer service, and reliability. Ensure they offer competitive rates and terms compared to the broader market.

2. Comparing Independent Financing:

While incentives for using preferred lenders can be attractive, it’s essential to compare these offers with what you might secure on your own. Independent banks, credit unions, and mortgage brokers may offer more favorable terms or products better suited to your financial situation.

- Rate Comparisons: Obtain quotes from multiple lenders to compare interest rates, fees, and loan terms.

- Flexibility & Products: Look for lenders that offer products tailored to new construction financing, which may include longer rate locks or flexibility with construction timelines.

3. Understanding Construction Loans:

Financing new construction often involves a construction loan, which is different from a standard mortgage. These loans can cover the cost of the land and construction before converting to a traditional mortgage.

- Two Types Of Loans: Learn about the two main types of construction loans: construction-to-permanent loans (which convert to a traditional mortgage upon completion of the home) and stand-alone construction loans (which require paying off the construction loan with a new mortgage).

- Interest Rates & Payments: Construction loans typically have variable rates that convert to a fixed rate once the home is completed. Payments may be interest-only during the construction phase, transitioning to full principal and interest payments afterward.

4. Loan Approval & Draw Process:

- Approval Process: The loan approval process for new construction can be more complex, involving the appraisal of plans and specifications.

- Draw Schedule: Understand how funds are disbursed to the builder during construction, known as the draw schedule, and how these draws are monitored and approved.

5. Long-Term Considerations:

- Equity Growth: Consider how your home’s value might appreciate from the time you lock in your financing to when you move in. This equity growth can positively impact your financial situation.

- Exit Strategies: Be aware of any prepayment penalties or restrictions on refinancing after construction is completed, especially if market conditions change.

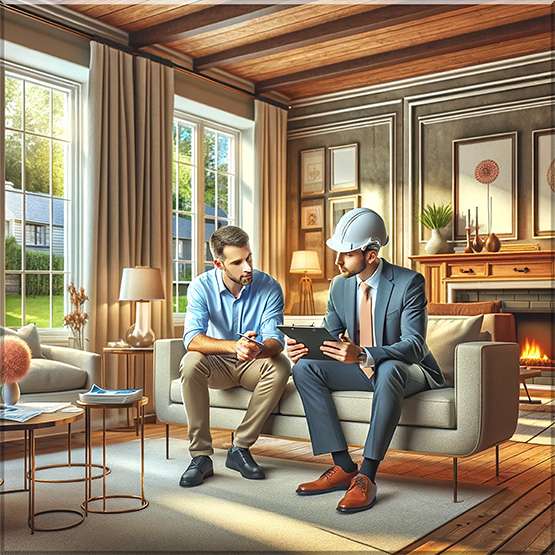

Question 11: How does the builder handle inspections & final walkthroughs?

1. Builder's Policy On Inspections:

Builders typically conduct their own series of inspections at various construction stages to comply with local building codes and standards. However, as a buyer, you have the right to a thorough understanding and possibly more:

- Independent Inspections: Ask if you can hire your own inspector to evaluate the home at critical stages or upon completion. Some builders welcome this transparency, while others may have restrictions.

- Inspection Stages: Inquire about the key stages at which inspections are conducted. Understanding these phases can help you plan if you intend to bring in an independent inspector.

2. Scheduling & Attending Inspections:

Knowing when inspections will occur and ensuring either you or your inspector can attend is crucial. This involvement allows for real-time questions and clarifications on the construction quality and practices:

- Confirm how the builder notifies you of upcoming inspections.

- Check if there are any limitations on who can attend (e.g., buyer, professional inspector).

3. The Final Walkthrough:

The final walkthrough is your last chance to identify any issues before closing. It typically occurs after construction is complete but before your move-in day. Here’s how to make the most of this opportunity:

- What To Look For: Check for incomplete work, cosmetic defects, or mechanical issues. Test all appliances, switches, and fixtures. Look at floors, walls, and ceilings for any damages or unfinished areas.

- Documentation: Document every concern, no matter how small. Use a checklist to ensure you cover all areas of the home.

- Builder’s Response: Understand how the builder documents your concerns during the walkthrough and their process for addressing these issues. Ask for a timeline for when repairs will be completed.

4. Post-Walkthrough Repairs:

- Clarify with the builder how post-walkthrough repairs are handled. Will there be a follow-up inspection to ensure all concerns are addressed? How will they communicate the completion of repairs?

5. Role Of The Buyer:

- Clarify with the builder how post-walkthrough repairs are handled. Will there be a follow-up inspection to ensure all concerns are addressed? How will they communicate the completion of repairs?

6. Legal & Contractual Aspects:

- Understand the legal and contractual implications if defects are found after the final walkthrough. Know your rights and the builder’s obligations to rectify any issues discovered after closing.

The inspection process and final walkthrough are fundamental steps in ensuring your new construction home meets your expectations in terms of quality and finish. By understanding the builder’s policies, actively participating in inspections, and meticulously conducting the final walkthrough, you can address any concerns before they become your responsibility. This proactive approach secures your investment and contributes to a smoother transition to your new home, with the assurance that it reflects the quality and standards you expect.

Question 12: What is the policy on handling defects or issues after move-in?

1. Understanding the Builder's Warranty:

2. The Reporting Process:

Knowing how to report issues is as important as knowing what’s covered. Ask the builder:

- How should defects be reported? (Email, dedicated portal, phone?)

- Is there a specific contact person or department for post-move-in issues?

- Are there any time limits for reporting problems once they are noticed?

3. Response Time and Resolution Process:

Clarify the builder’s typical response time once an issue is reported. Understand the steps involved in assessing and addressing the defect. Some questions to consider:

- How quickly will the builder or a representative inspect the reported issue?

- What is the timeline for resolving defects?

- How does the builder ensure the quality of repairs or corrective work?

4. Emergency Issues:

5. Customer Service and Support:

The level of customer service provided after move-in can significantly impact your satisfaction. Inquire about:

- The builder’s philosophy on customer service post-move-in.

- Any dedicated support teams or resources available to homeowners.

- Feedback from current homeowners on their post-move-in experience.

6. Document Everything:

7. Third-Party Inspections:

Understanding the builder’s policy on handling post-move-in defects and issues is critical. It not only affects your immediate living experience but also the long-term enjoyment and value of your home. By asking detailed questions about the reporting and resolution process, warranty specifics, and customer service, you can gauge the builder’s reliability and commitment to quality. This knowledge empowers you to make an informed decision and ensures you’re prepared to handle any issues that may arise, securing your investment and peace of mind.

Conclusion

Purchasing a new construction home is an exciting journey that offers the unique opportunity to tailor your living space to your preferences. However, it’s crucial to approach this process with a blend of excitement and pragmatism. The questions outlined in this blog post are your tools for due diligence, ensuring that your new home meets not just your current needs but also your long-term expectations.

Remember, the quality of your new home extends beyond its walls. It encompasses the builder’s reputation, the community’s future, and the day-to-day costs of living in your new space. By asking these 12 essential questions, you’re not just buying a house; you’re investing in your future happiness and security.

Before making your final decision, take the time to:

- Visit the community at different times of the day to get a feel for the neighborhood and its dynamics.

- Speak with current residents to gain insights into their experiences with the builder and the community.

- Review all documents thoroughly, especially those related to warranties, HOA rules, and any builder promises regarding construction timelines and finishes.

This journey is about more than just finding a new house; it’s about creating a home where your life will unfold. With the right questions and a careful approach, you can confidently navigate the process, making informed decisions that align with your dreams and expectations.

Buying a new construction home is a significant milestone, and armed with the correct information, you’re well-equipped to make choices that will bring lasting satisfaction and joy. Remember, the key to a successful homebuying experience is not just asking questions but ensuring you’re comfortable and clear with the answers. Your new home awaits, and it’s a canvas ready for you to bring your vision to life. Happy home buying!

Feel free to contact Coats Construction Concepts for any inquiries or to schedule your complimentary consultation. We eagerly anticipate the opportunity to collaborate with you!

References & Additional Information

1. Federal Trade Commission's Consumer Advice

They Offer a comprehensive overview of warranties for new homes, covering the differences between builder warranties and service contracts, what’s typically covered, and the claims process.

“Warranties For New Homes” By Federal Trade Commission Consumer Advice

2. The Mortgage Reports

The Mortgage Reports offers a detailed guide on buying a new construction home, emphasizing the importance of getting pre-approved for a mortgage, choosing the right type of home and builder, and understanding the different financing options available for new constructions. It highlights the differences between tract, spec, and custom homes and the specific considerations for each regarding financing and timelines.

“Guide To Buying A New Construction Home In 2024” By Valencia Higuera from The Mortgage Reports

3. HomeLight

HomeLight offers tips on choosing floor plans based on current and future needs, the importance of reading the fine print in builder contracts and negotiating everything possible to get the best deal. It suggests choosing upgrades that increase the home’s value, planning for potential delays, asking for leftover materials for future repairs, and managing expectations when comparing model homes to your finished home.

4.Orchard

Orchard emphasizes the decision-making process in choosing the right type of builder, making smart design and upgrade decisions, and the importance of putting in an offer and negotiating terms. It also outlines the steps involved in starting the construction process, including what to expect during inspections and, the final walkthrough and the excitement of closing and moving in.

5. National Association of Home Builders (NAHB):

National Association of Home Builders (NAHB) Offers detailed guides and articles on buying new construction homes, understanding warranties, and what to expect during the home buying process.

- Website: NAHB – Home Buying

6. U.S. Department of Housing and Urban Development (HUD):

U.S. Department of Housing and Urban Development (HUD) provides resources for homebuyers, including information on rights, financing, and tips for first-time buyers.

7. Consumer Financial Protection Bureau (CFPB):

Consumer Financial Protection Bureau (CFPB) offers tools and resources on understanding home loans, mortgages, and other financial aspects of buying a home.

8. Energy Star:

Energy Star for information on energy-efficient homes and appliances, which can be a significant aspect of new construction homes.

9. The American Society of Home Inspectors (ASHI):

The American Society of Home Inspectors (ASHI) provides insights into the importance of home inspections, what to expect, and how to find a qualified inspector.

- Website: ASHI – Find a Home Inspector